Why Young Buyers Are Turning to Plexes in Quebec in 2025

Why 2025 Could Be the Right Year to Buy in Montreal

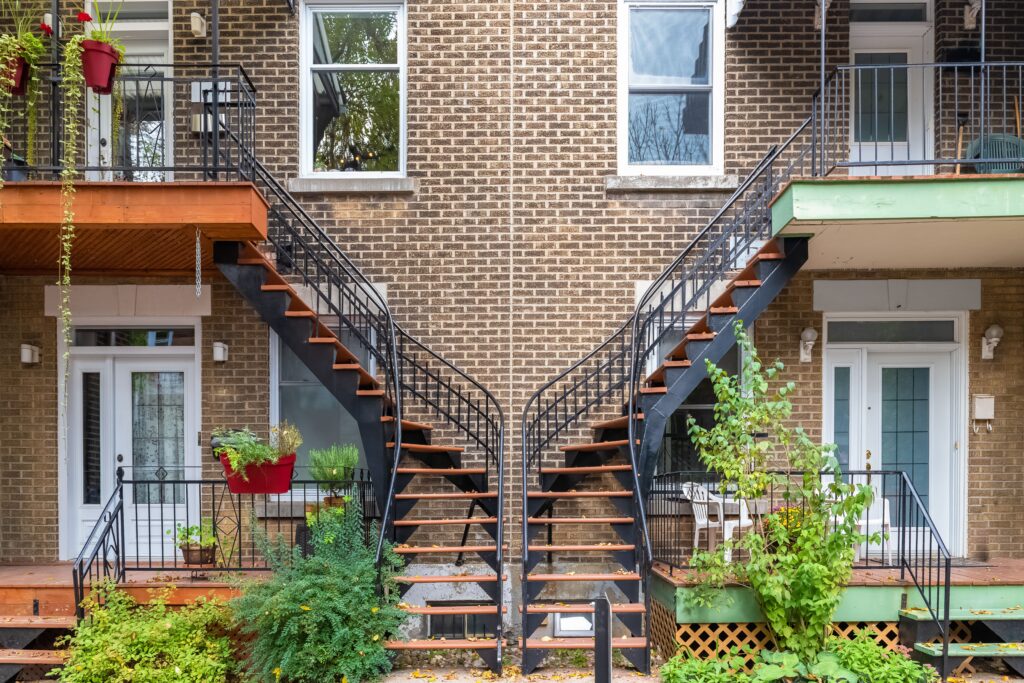

In 2025, Quebec’s real estate market is buzzing: homes sell quickly, prices are rising, and the offer is diversifying. In the midst of this activity, more and more young people are looking for a strategy that lets them access property without sacrificing financial stability. Plex properties in Quebec real estate market—duplexes, triplexes and quadruplexes—are emerging as an ideal solution because they combine housing and rental income under one roof. In this post, we analyse why plex properties in Quebec’s real estate market have become the star category, explore their advantages and disadvantages, and share practical tips for those who want to take the plunge into real-estate investing.ting.

What is a plex?

A plex is a small multi‑unit dwelling in which the owner can live in one unit and rent out the others. The First‑Time Home Buyer Incentive (FTHBI) fact sheet from the Canada Mortgage and Housing Corporation (CMHC) lists duplexes, triplexes and fourplexes alongside single‑family homes and semi‑detached houses as eligible residential property. These properties have one to four units and must be suitable for year‑round occupancy. Because plexes fall under the same lending rules as other owner‑occupied homes, they offer a more accessible entry point into real estate investing.

Advantages of Investing in Plex Properties in Quebec Real Estate Market

Minimum down payment

Government mortgage‑insurance guidelines make owner‑occupied plexes more attainable than many expect. According to the FTHBI fact sheet, 1‑ and 2‑unit properties require a minimum down payment of 5 % on the first $500 000 of the lending value and 10 % on the remainder, while 3‑ and 4‑unit properties require a 10 % down payment. This minimum is significantly lower than the 20 % down payment typically needed for purely rental properties. It allows first‑time buyers to enter the market with a relatively small amount of capital, provided they intend to live in one of the units.

Energy‑efficiency incentives

The federal Canada Greener Homes Initiative offers grants and energy‑efficiency upgrades to low‑rise multi‑unit residential buildings (MURBs). Natural Resources Canada defines a MURB as a building with two or more units; to qualify, the structure must have three or fewer storeys, a building area under 600 m² and at least half of the floor area dedicated to residential living space. Two‑unit MURBs (including houses with secondary suites) are eligible for the same grants as single‑family homes. These incentives can help reduce energy bills and increase comfort for both the owner‑occupant and tenants.

Tax advantages for owner‑occupant landlords

Owning a plex is not just about rental income; Canadian tax rules allow landlords to deduct many expenses associated with earning that income. The Canada Revenue Agency’s T4036 Rental Income guide explains that landlords can deduct advertising costs, insurance premiums and interest on money borrowed to buy or improve a rental property canada.ca. The guide also notes that the cost of minor repairs and maintenance is deductible, as are salaries or wages paid to superintendents and other employeescanada.ca. Property taxes incurred while the unit is available for rent are deductible, and landlords can claim travel expenses to collect rents or supervise repairs as well as utilities they pay on behalf of tenants. These deductions reduce taxable rental income, making plex ownership more financially attractive.

Why plexes appeal to young buyers

- Mortgage assistance through rental income. Renting out the extra units allows owners to offset a significant portion of their mortgage payments. With the lower down‑payment requirement for owner‑occupied plexes, monthly costs can be easier to manage, and rental income accelerates the build‑up of equity.

- Government support and grants. CMHC’s FTHBI lowers the barrier to entry by permitting down payments as low as 5 % for 1‑ and 2‑unit properties and 10 % for 3‑ or 4‑unit homes. Energy‑efficiency grants under the Greener Homes Initiative apply to multi‑unit dwellings, allowing owners to upgrade insulation, heating and windows and reduce operating costs.

- Tax deductions reduce operating expenses. CRA guidelines permit deductions for advertising, insurance, mortgage interest, repairs, salaries, property taxes, travel and utilities. These deductions can offset rental income and improve the overall return on investment.

- Contribution to housing supply. Government policy encourages gentle density to address the housing shortage. By purchasing and upgrading plexes, young buyers are part of the solution, increasing the number of rental units and benefitting from programs designed to support multi‑unit ownership.

Considerations and challenges

While plexes offer many advantages, potential buyers should be aware of the responsibilities involved:

- Shared living environment. Living in close proximity to tenants requires good communication and a willingness to resolve issues quickly. Privacy can be limited compared with a single‑family home.

- Management duties. Owners must handle maintenance, manage tenancies, comply with local housing regulations and budget for repairs. Even though many expenses are deductible, they still require upfront cash and time.

- Vacancies and tenant risk. Rental income is not guaranteed. Buyers should maintain a reserve fund to cover mortgage payments and repairs during vacancies.

Tips for prospective plex buyers

- Assess affordability carefully. Determine how much you can borrow and what rents you can reasonably expect. Include property taxes, insurance and maintenance in your calculations.

- Prioritise location and demand. Look for neighbourhoods with strong rental demand, good transportation links and amenities. These factors influence both vacancy rates and long‑term appreciation.

- Understand your obligations. Familiarise yourself with Quebec’s landlord–tenant legislation and municipal bylaws. Ensure leases, deposits and notices comply with local requirements.

- Plan for upgrades. Improvements to insulation, heating and windows may qualify for federal energy‑efficiency grants and can make your property more attractive to tenants.

- Consult professionals. A real‑estate broker, mortgage specialist and accountant can help you evaluate properties, secure financing and maximise tax deductions.

How Daphne Immobilier can help

Daphne Immobilier specialises in the Quebec market and understands the nuances of plex transactions. We can help you identify properties with strong rental potential, analyse cash‑flow projections and navigate mortgage‑insurance rules like the FTHBI. Our network of inspectors, contractors and legal professionals ensures that your purchase meets regulatory requirements and that any renovations align with programs such as the Canada Greener Homes Initiative. By partnering with us, you gain a trusted advisor committed to helping young buyers build wealth through smart real‑estate investments.

Conclusion

Multi‑unit homes are no longer just the domain of seasoned investors. With government initiatives that favour gentle density, down‑payment rules that make plexes accessible and tax deductions that improve cash flow, duplexes, triplexes and four plexes provide a compelling path to home ownership for young Quebecers. By living in one unit and renting the others, buyers can reduce their mortgage burden while contributing to the province’s housing supply. With careful planning and professional guidance, a plex can be the cornerstone of a strong financial future.

Whether you’re a first-time investor or an experienced buyer, exploring plex properties in Quebec’s real estate market can open the door to financial growth and stability.